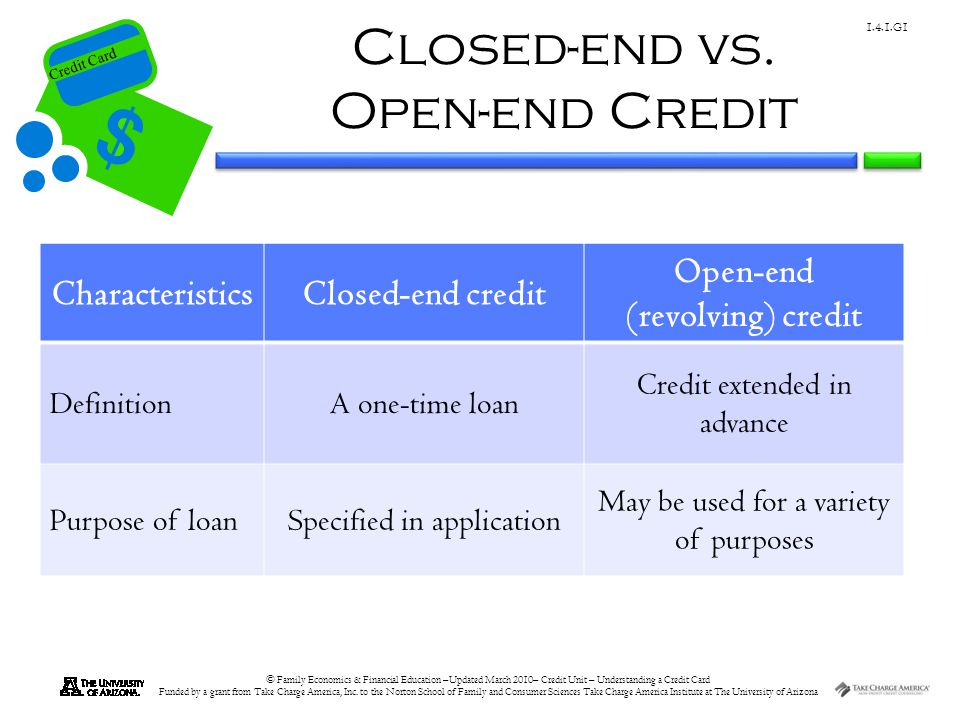

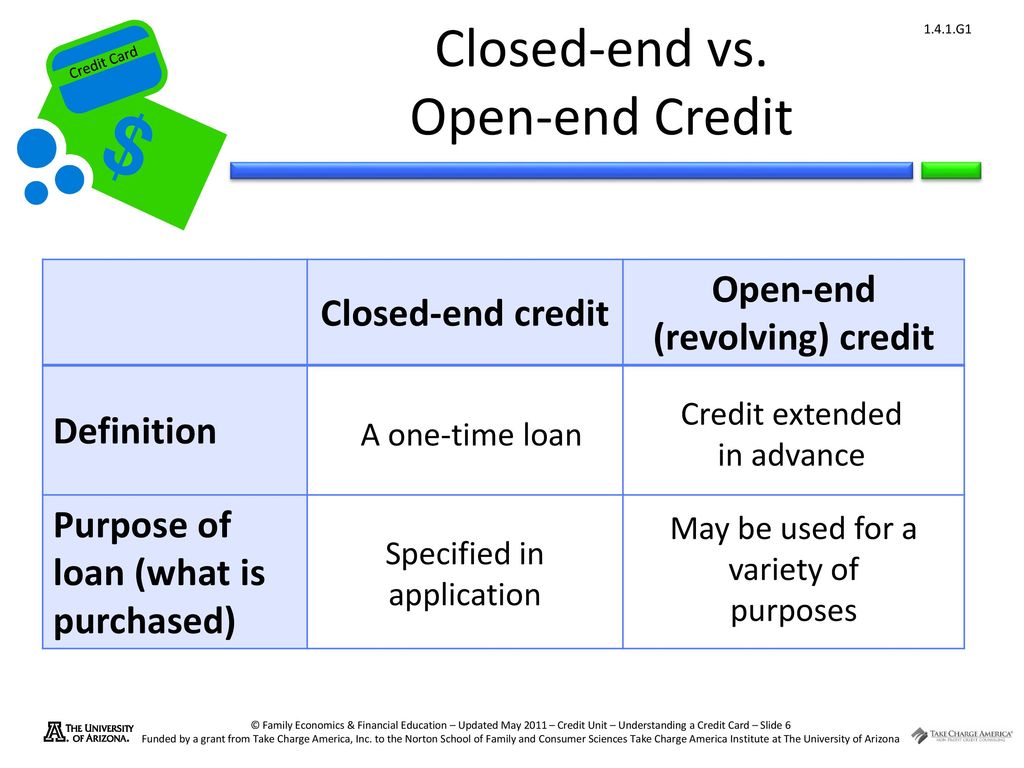

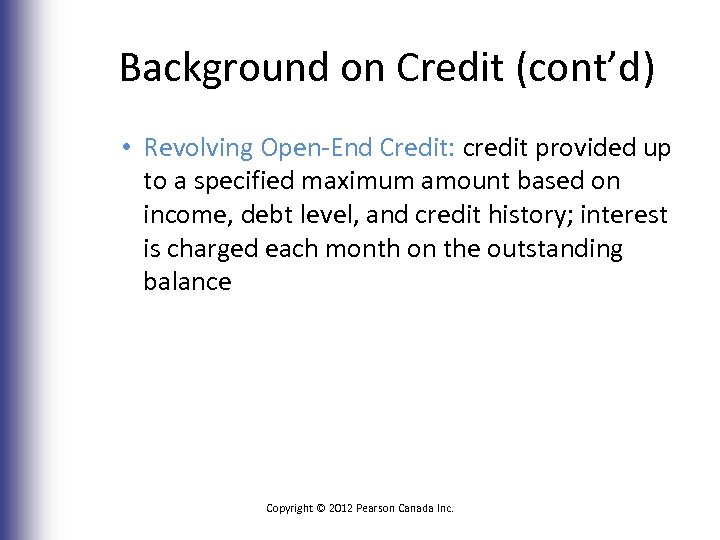

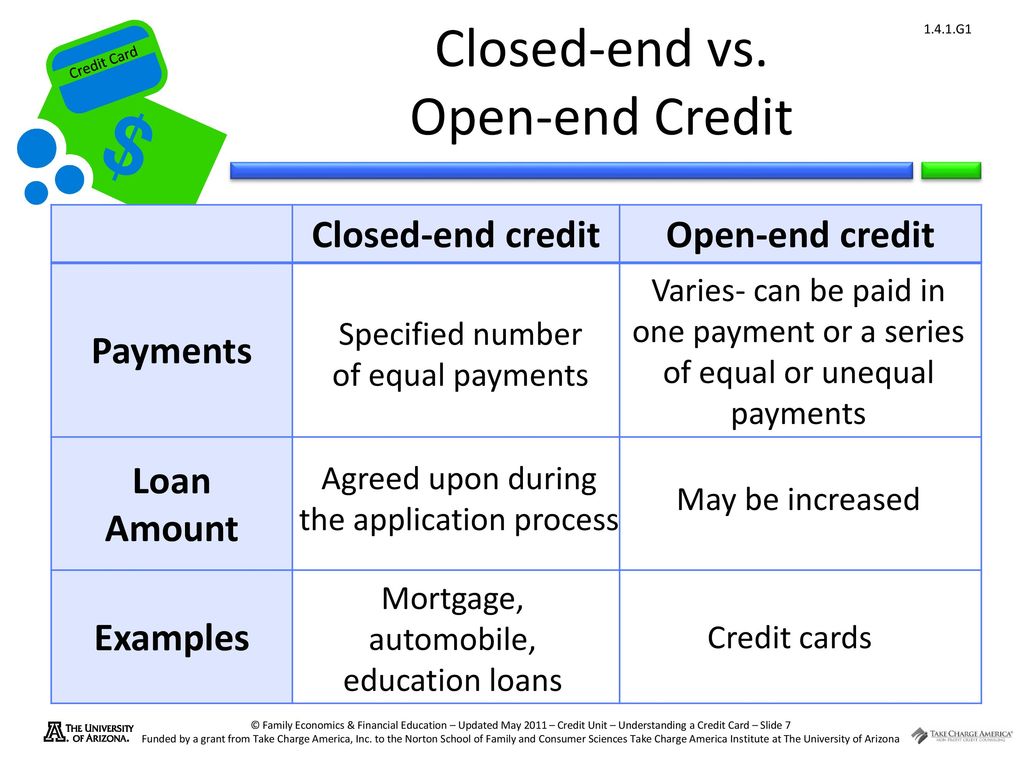

Finance charges are based on your changing balance and can change on the bank's whim. This means that you are given a credit limit by credit card companies and a consumer must repay a part of credit at the end of a credit period.

Consumer Credit Chapter 15 Section 1 - Ppt Download

You can access money until you've borrowed up to the maximum amount, also known as your credit limit.

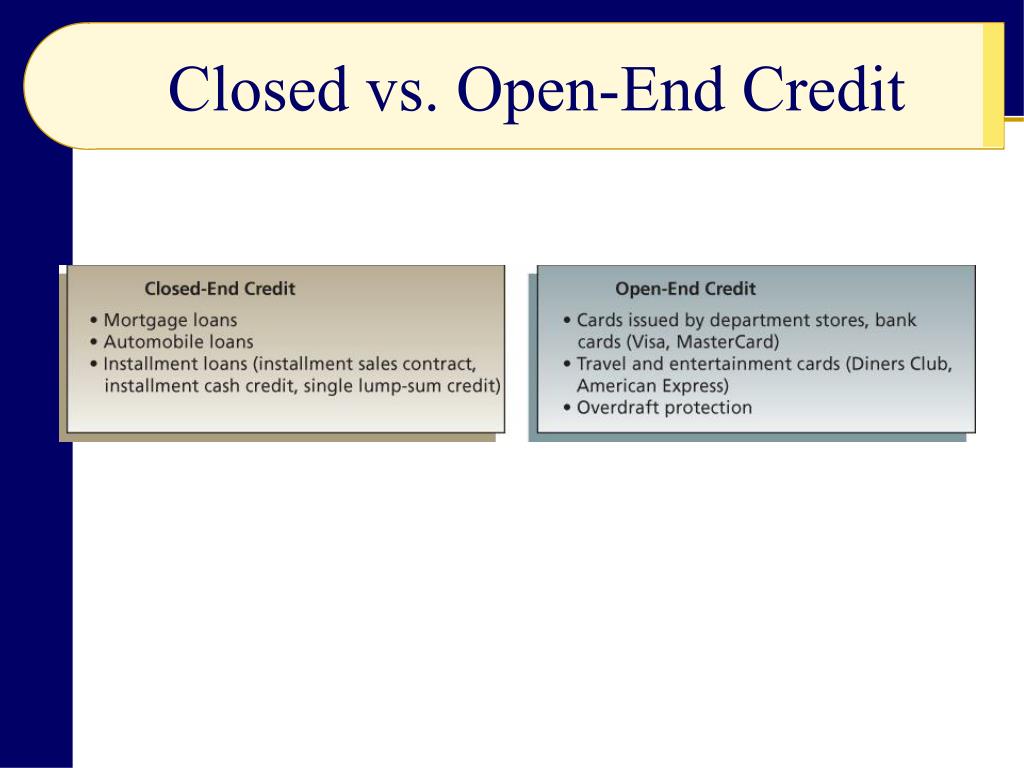

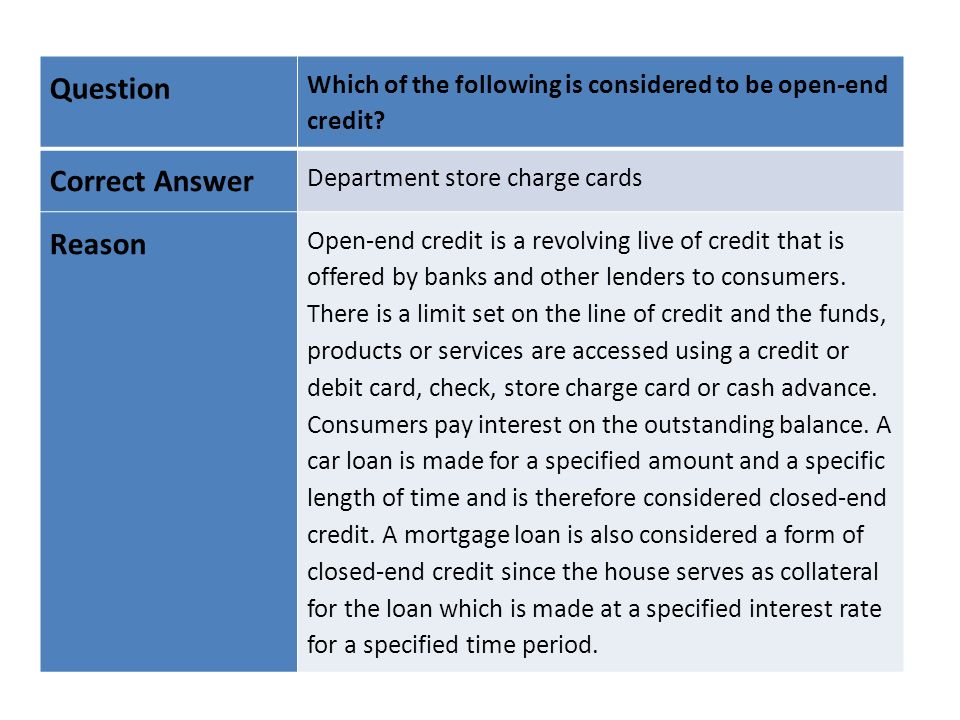

What is considered open end credit. A credit card a personal line of credit or a home equity line of credit are all considered to be open ended. C.) getting a small loan with a cosigner and have the co. Store or service credit cards and home equity credit lines are also considered to be open end credit.

The payment consists of the amount actually borrowed plus the interest charge. Examples include credit cards, home equity loans, personal lines of credit and overdraft protection on checking accounts. For instance, in missouri, the written account statute of limitations is 10 years;

This preview shows page 2 out of 2 pages. Home equity lines of credit will only be given if you have equity in your home. Any periodic rate that may be applied expressed as an "annual percentage rate" using that term or the abbreviation "apr".

If you have none you will need to pursue a personal line of credit. Which type is considered more dangerous and why, how do lenders offset the dangers of giving. As you repay the outstanding balance, plus any interest, you unlock.

The cost of these types of credit are fees and interest rates charged by the lender. If the plan provides for a variable rate, that fact must be disclosed. Leah is trying to explain the difference between open‐end and closed‐end credit to her roommate.

Line of credit where pays a fee to borrow money from a financial institution. Revolving credit is a type of loan that gives you access to a set amount of money. The open account statute is 5 years.

Equal payments are required on a regular basis until the loan is repaid. B.) opening a checking account, making regular deposits, and avoiding penalties for insufficient funds. Open end credit helps the borrower to control the amount they borrow.

Key points to know about open end credit. Which statement should she include in her description of closed‐end credit? The state statute of limitations on a credit card may come down to whether the agreement or application is in writing or not to determine whether it meets the required elements of a written contract.

What Is Closed-end Credit What Does Closed-end Credit Mean Closed-end Credit Meaning - Youtube

Open End Credit Examples - Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

Ppt - Credit Basics Powerpoint Presentation Free Download - Id1802708

Understanding Your Credit Card - Ppt Download

Understanding A Credit Card - Ppt Download

Ppt - Chapter 6 Credit Use And Credit Cards Powerpoint Presentation Free Download - Id728625

Credit Credit Another Word For Borrowing 2 6

Chapter 6 Assessing Managing And Securing Your Credit

Understanding Open - End Credit - Youtube

Credit Bell Ringer 1 Is A Credit Card

What Is Open-end Credit Transunion

What Is The Definition Of Revolving Open End Credit What Are Some Examples Line Course Hero

Understanding Open - End Credit - Youtube

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed-end Credit Vs An Open Line Of Credit

Understanding A Credit Card - Ppt Download

What Is An Open-end Loan

Wise Test Review - Ppt Download

12 1 Installment Loans And Closedend Credit N

Consumer Loan Application Credit Union Form Httpwwwoaktreebizcomproducts-servicesconsumer-lendi Credit Card Application Consumer Lending Personal Loans

What Is Considered Open End Credit. There are any What Is Considered Open End Credit in here.